Stock markets fall with a great deal more regularity than many care to believe. Sometimes falling markets reflect investors’ collective fear that profits will fall generally across the economy. The causes of fear can be varied but usually involve concerns of rising interest rates slowing the economy. At other times, political events, trade friction with other countries, regulatory threats or excessive speculation drive investors to reassess their commitment to stocks in general. In all cases, the general ebb and flow of fear and greed—the most powerful drivers of market direction in the short-term—inevitably allow the market to regain its balance.

Investors rightly wish to avoid the stress of decreasing portfolio values and we, as your advisors, do our best to avoid such instances. Inevitably, we too get caught to some extent in the general direction of the masses. We are often asked why we did not sell more stocks to avoid the decline. It’s a fair question but one fraught with hindsight bias. It is also because we believe in the long-term success of owning great businesses and allowing them to compound over time and to avoid certain losses to taxes in the short-term. A simple example using Amazon illustrates the conundrum.

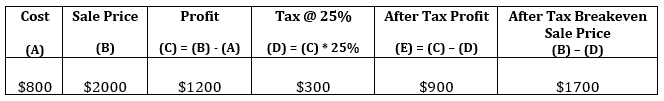

The DRL Equity Fund purchased Amazon at $762/share. The company hit a peak of $2050 and on its happy trip towards this peak we did sell some of our position, but not all. We sold some to reduce risk to the overall portfolio. We did not sell all of it because its long-term future remains very bright. The stock has fallen recently to $1600, a sharp drop of 20%. This is not an unusual drop for any stock at any point in time. In fact, Amazon has experienced many drops like this in its history, always to regain new highs down the road. Nonetheless, if we had had perfect foresight and sold the entire position at $2000, we would have lost a certain $300 to taxes.

Your portfolio would have suffered a permanent reduction of capital of the $300 taxes payable. Multiply this unhappy math across all the stocks which have been compounding tax-free in the portfolio and multiply that by the highly unlikely odds of selling everything at the “top” and getting back in at the lows (perfect hindsight required again) and you get a very poor outcome over the longer term. The taxman wins for sure and you are no further ahead.

Portfolio managers with a charge to grow your assets over the long-term must balance the task of managing volatility and reducing your stress with the facts of uncertain short-term results and taxes. We must be prepared to “take the heat” in the short-term with the expectation that over the longer term we have selected companies with bright long-term futures. Doing the right thing sometimes means we look dumb in the short-term. Results are all too often measured not just in the short-term but also wishing away the costs of taxes. We also do not possess a crystal ball that tells us when to sell or buy. We believe in the long-term compounding results of good companies. Its proof is everywhere—ask Warren Buffett. Buffett’s Berkshire Hathaway, one of the most successful investments of all time, has had regular drops of 25% throughout its long history. Buffett’s success is due to buying great companies at fair prices and watching them grow, and not paying taxes. He is not a trader and nor are we.

The only risk is that this market weakness continues for a period, which it may. That having been said, we feel there are compelling values in the portfolio and positive expected returns within a 2-3 year horizon. We have lots of cash (18%) and have reduced that a bit recently adding to some of our positions. Interestingly, Warren Buffett was reported to have increased positions in some of the same things we own. We don’t copy him; it’s just that we tend to like the same kind of characteristics in businesses. He, and we, recently added to Goldman Sachs, JP Morgan Chase, and PNC Financial Services.

Here is a rundown of a few companies we own and how much they are off from their highs this year to their lowest prices this year. Interestingly, all of them are trading below their 10-year average valuation metrics (price to cash flow and earnings per share). Their profits are all up and likely will be up for the next few years at a minimum…

Apple -23%

Activision Blizzard (largest gaming company in the world) -40%

Amazon.com -26%

Aptiv (the command and control brains of your car) -32%

Booking Holding (the largest travel agency in the world) -22%

Google (Alphabet) -20%

Goldman Sachs -29%

JP Morgan Chase -13%

Keyera -24%

Stanley Black and Decker -38%

PNC Financial Services -29%

Energy stocks are all down about 50-60% in the past 9 months. People are begging the government to do something. It would be hilarious if it weren’t so sad. When something is unsustainable (like Canadian oil at $15/barrel today) something MUST happen. When oil was at $28/barrel two years ago, people were saying it would trade below $30/barrel for years. That would have led to bankruptcies around the world for governments, oil producers and ALL of the banks. Eighteen months later, oil was trading at $80/barrel. Suffice it to say the companies we own are survivors and trading at about 2 times cash flow when prices return to normal. That is amazing value! What’s normal pricing for oil in Canada? Oil was at $60/barrel three months ago and stocks 50% higher. When will prices recover? Sometime next year. Would you buy something with better than EVEN ODDS that it will double in a year? I bet you would. Unfortunately, investors generally drive with their eyes firmly in the rear-view mirror.

The market is as wild as ever and prices have fallen everywhere. So, what should we do?

We buy companies that are well managed and financed, with good products and services. We try to find industries that are growing faster than the economy. We especially like essential or very popular items with very large addressable markets. Next, we identify the best companies in that industry. We make sure we understand what they do. We listen to and read what management says. Do they tell the truth? Do they usually exceed expectations? We look at years of financials to see how they have managed their cash flows and balance sheet. We look at their customers and think about their health. In short, we buy companies and we tend to hold them for a long time and let them compound your wealth tax-free.

Presently, many great companies are cheaper by 20-60%. People think that’s bad!? It’s rearview investing. Our clients are investors and they don’t need all their money today. Frankly, even if we had sold everything at each of their distinct tops and bought them back today, you’d be no further ahead after tax. Thankfully, we have cash kicking around in your portfolios because we did some pruning earlier in the year when everyone was happy. We pruned technology companies mostly, because of the likelihood of increased regulation and taxes. We sold all of our Facebook because it’s the most at risk and in the end, the least diversified platform and as such, the least likely to grow out of its problems.

So here we are. Could things get cheaper? Yes. Will they? Possibly. By how much? We haven’t a clue. We love the companies we own. If they go lower, we will buy more because we have the cash, they are great businesses for the long-term and they are getting very cheap.

like the philosophy and the companies; keep the faith and all will be well; one scary cosmetic is what will Trump do next? he seems unhinged at the moment; will this impact US markets?

LikeLike

I think the markets ultimately are more concerned with growth. That growth concern is mostly being driven by the perceived path of interest rates which is supposed to be a non-political issue. So a “non-Trump problem.” The paradox that needs to be resolved is this: the Fed raises rates because it thinks the economy is strong and wants to limit inflationary pressures. The “market” worries they will raise it too much. We think the Fed is as well informed as the market and takes signals from the market as well. They do not have a goal to destroy economic activity. Yesterday, in our investment committee meeting, we were trying to think about what the market will be worried about or talking about in 18 months. What we are worrying about today has already happened, for the most part, and has been priced in and reflected in today’s prices. Theoretically, that’s what is being priced in now. In 18 months we will be talking about who will win the next election and if Trump is even running. We will likely see a path to some type of trade resolution. On the China friction, we feel China loses the most and most companies we own have minimal exposure (although Apple has significant exposure). The dilemma for China is that it needs Apple more than Apple needs it. This is not to imply that Apple would not be hurt but the millions of jobs lost in China would be very bad for the government. Trump is only noise and advertising revenue. We will likely be talking about how the Fed is on hold because they don’t want the now record-long economic expansion to be hurt going into the election. In short, Trump likely won’t be any more relevant than he is today and for the most part that’s increasingly not an issue.

Thanks,

John

LikeLike